Benefits of Saving For College With The Upromise MasterCard

Disclosure: I received compensation from Upromise by Sallie Mae in exchange for writing this review. Although this is a sponsored post, all opinions are my own.

Even though my boys are still fairly young, my husband and I feel that it is never too early to start saving towards their college education. I know that many people in the New Year make resolutions to become healthier and more physically fit, but why not let this year be the year to focus on your financial fitness? Financial fitness, for many people, includes saving for college. Nearly all families agree that college is an important and worthwhile investment; almost 60 percent, however, feel overwhelmed about saving for it, according to the How America Saves for College 2015 report by Sallie Mae and Ipsos.

This year, why not invest in a credit card that will invest in you back? The Upromise MasterCard means more cash back to help you reach your savings goals. I love the Upromise MasterCard as it rewards with me Cash back earnings towards my children's college education. How awesome is that? In fact, with the Upromise MasterCard, you earn up to 10 percent Cash back! And, on top of that, when you open the Upromise MasterCard, you’re automatically enrolled in Upromise by Sallie Mae, a free program that allows families to earn cash back on everyday purchases. Upromise by Sallie Mae members have earned more than $900 million in cash back for college! Whether saving for a child's college education, paying for it now, or repaying student loans, Upromise enables you to earn cash back through everyday purchases.

What’s more, by applying for the Upromise MasterCard® — issued by Barclaycard — families can take saving for college and other financial goals to the next level. Upromise by Sallie Mae members can earn higher cash-back rewards and grow their college savings more quickly with the Upromise MasterCard. Last year, Upromise MasterCard holders earned $42 million in cash-back rewards!

Are you ready to start saving? Here are 5 Reasons Why Your Family Should Consider the Upromise MasterCard®:

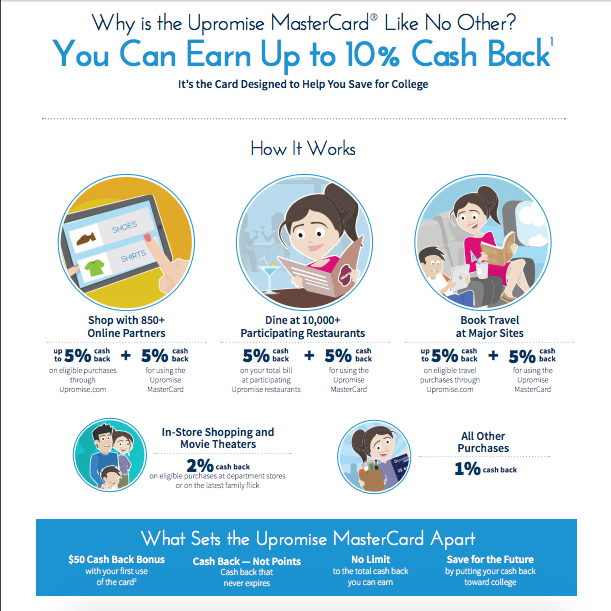

1. Earn up to 10 percent cash back. Really.

With the Upromise MasterCard, you can earn up to 10 percent cash back. You earn five percent back through Upromise by Sallie Mae, and an additional five percent from using the Upromise MasterCard. Here’s how: Shop at more than 850 online retail partners at Upromise.com, Dine at more than 10,000 Upromise participating restaurants, and Book travel at major travel sites via Upromise.com, Oh and there's even more! You can also earn two percent cash back when using the Upromise Mastercard for in-store shopping at major department stores and at movie theaters. All other purchases with the card are eligible for one Percent cash back. New cardmembers can also earn a one-time $50 cash-back bonus after making a purchase, cash advance transaction, or Balance transfer within 90 days of opening an account.

2. Build college savings.

Saving for college can feel like a marathon but the Upromise MasterCard can help you sprint ahead. When families open a Upromise MasterCard account, they’re automatically enrolled in Upromise by Sallie Mae, and they can immediately start earning up to 10 percent cash back. The cash back earned on everyday purchases can be invested in an eligible 529 college savings plan, used to help pay down an eligible student loan, transferred into an FDIC-insured Upromise GoalSaver account, or withdrawn by check. Last year, Upromise MasterCard cardmembers collectively earned $42 million in cash back for college. Collectively, the Upromise MasterCard program has awarded $470 million in total cash back rewards.

3. No Annual fees, no cash back limits, and no expirations.

Unlike other credit cards that offer points that expire or you may simply never redeem, the Upromise MasterCard means cash back. There are no limits to how much cash back you can earn. No expirations and no annual fees. It’s that simple. Also, there are no rotating cash-back categories. In addition, you’ll stay on top of your credit with free access to your FICO Credit Score, and enjoy $0 fraud liability on unauthorized transactions.

4. You’ll shop where you’re already shopping – just earning more.

With more than 850 online retail partners, more than 10,000 restaurants, and multiple major travel sites, chances are most families are already shopping, dining, or booking travel through a Upromise partner. So why not earn cash back and start boosting savings on purchases from major retailers like Lowe’s, Old Navy, and The Disney Store, and travel sites like Travelocity, Hotels.com, and Expedia? For a complete list of Upromise partners, visit Upromise.com. This really is a no-brainer idea, right? You are going to eat out and buy clothing for the family so why not earn cash back for those purchases? Think about if you travel for business or if you are planning a Spring Break getaway -- when you book using the Upromise MasterCard you will have peace of mind knowing that your well-deserved Vacation earned you 10 percent cash back earnings toward paying or planning for college!

5. You can earn extra through special promotions throughout the year.

Upromise partners with major retailers to offer special promotions that offer additional cash back opportunities at major online retailers. For Upromise MasterCard cardmembers that can mean cash back savings of of more than 15 percent. Cardmembers also receive special cash back offers via email.

Are you ready to start making Financial Fitness goals towards your children's education? NOW is the time to benefit and plan! Open up your Upromise MasterCard and let the saving begin!

Email Article

Email Article  Post a Comment tagged

Post a Comment tagged  SallieMae,

SallieMae,  Upromise Posted on

Upromise Posted on  Monday, February 8, 2016 at 10:49AM

Monday, February 8, 2016 at 10:49AM

Reader Comments