Saving Is Easy With Upromise GoalSaver by Sallie Mae!

Disclosure: I received compensation from Upromise by Sallie Mae in exchange for writing this review. Although this is a sponsored post, all opinions are my own.

Can you believe that school has already been back in session for over a month? What better way to celebrate than getting a jump-start on saving for your children's College education and more than with Upromise GoalSaver by SallieMae?

Even though my boys are still fairly young, I feel that it is never too early to start saving for their future education. I consider myself pretty good in the savings department especially when it comes to the family budget so why not put those savings towards my children's education and other financial goals?

Upromise GoalSaver is Sallie Mae's new and simple way to save for College and other Goals. GoalSaver is a Free, no-fee savings account that allows you to save for college and other goals all in one place. It provides tools to help you stay on track and helps get you motivated. You will also receive a $10 annual bonus for creating automatic deposits AND receive a 10% match on Upromise Cash Back Rewards! GoalSaver is just what our family needs to help us keep on track for all of our financial goals. Did you know that experts say that saving is easier with specific goals because you visualize the prize rather than the process?

For example: My husband and I have a financial goal to save for a dream house and a new vehicle. If we did not have a goal and set aside money each month for those things, then it would be hard to reach that goal, right? Having a set goal keeps your focus where it needs to be towards the prize!

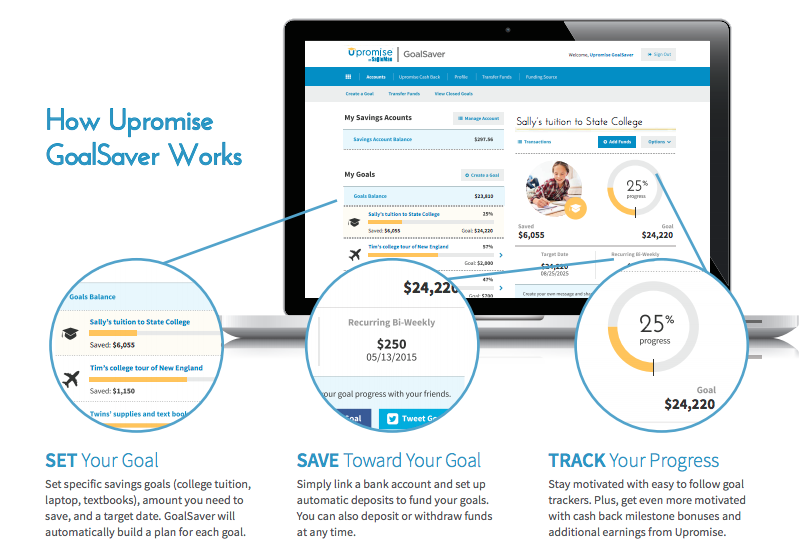

I love that Upromise GoalSaver is super easy to use and you can get started saving right away:

- Sign up for your Free account.

- Set your Goals.

- Save Towards Your Goals.

- Track Your Progress.

- Earn Rewards.

Here are a couple of ideas that have been helpful to me personally when it comes to saving:

Don't Worry. Start Saving -If you are anything like me, I know that when it comes to finances I tend to worry too much. Most of the time my hubby handles the finances, but I like to be involved in the day-to-day decisions as well. If you are thinking to yourself, "I have no money to save for future goals and education" Think again. If you were to trade one or two fancy coffee drinks each week towards your Upromise GoalSaver account that would be about $10 each week that can be set aside for what matters most in your family's life. As you can see, that $10 a week will add up to $520 a year! Isn't that an astounding number when you think about it? Upromise GoalSaver helps make saving a habit: The old adage is, “Set it and forget it,” GoalSaver allows families to do just that.

Only buy what you need don't buy what you want - I am stepping on my own toes here as I make this point. Isn't it easy to go shopping and see a cute piece of clothing or jewerly and tell yourself, "It is only a few dollars and that isn't going to matter?" BUT, in the grand scheme of things, these little niceties (not necessities) definitely add up don't they? If you do buy items, make sure that you are not leaving money on the table. Upromise.com has partnered with hundreds of retailers and will pay you up to 5% cash back towards college while making everyday purchases. In addition to saving up to 5% when shopping online, users can earn an additional 5% when shopping online, at restaurants, for online travel and more with the Upromise MasterCard!

So, how about it? It is time NOW to plan for your children's future education and your Financial Goals. Sign up for your Free Upromise GoalSaver account and start saving for the Future today!

Email Article

Email Article

Reader Comments